Retailers adopt m-payments to profit from Chinese outbound tourism boom

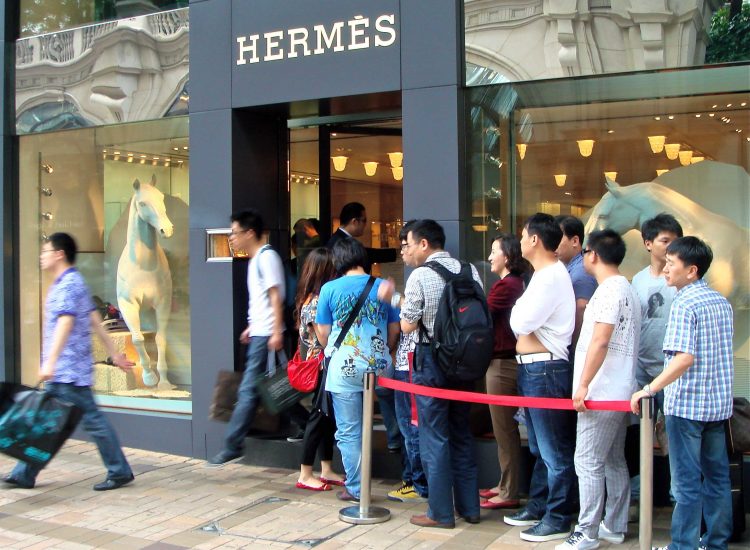

Visit any popular destination in the world and you will likely see Chinese tourists. When not visiting the tourist attractions, they love to shop. They also like to use their mobile phones to pay, something that is taken for granted in China. So, retailers that want to want to profit from China’s outbound tourism boom should consider adopting mobile payments.

Traveling abroad is no longer a luxury for many Chinese and, according to the China Tourism Academy, 140m outbound trips were made in 2018, a growth of 13.5% year-on-year.

In 2018, 69% of Chinese tourists paid with their mobile phones while abroad, an increase of 4 percentage points over the previous year, according to a survey by market research firm Nielson.

M-payments overtake cash

Measured by transactions, m-payments grew to be second most popular payment method for Chinese tourists abroad, accounting for 32% of transactions in 2018 and overtaking cash (30%) for the first time, but still some distance behind bankcards (42%).

In China, the m-payments market is dominated by Alipay and WeChat, and in China’s major cities, m-payments are by far the preferred way of paying for anything, so much so that cash transactions are in steep decline. Unsurprisingly, when Chinese tourists travel abroad they expect to also be able to pay with their mobile phone.

Retailers in the Southeast Asian destinations that were first to benefit from the Chinese tourism boom were quick to realize the importance of accepting Chinese m-payments.

According to Nielsen, 90% of the merchants surveyed in Singapore, Malaysia and Thailand had experienced Chinese tourists asked if they could pay with their mobile phones.

Rapid growth in acceptance

More than half of them (58%) now accept m-payments with 70% of them accepting Chinese m-payments. By comparison, only 12% of them accepted Chinese mobile payment in 2016, which shows how rapidly acceptance has grown.

But its not just retailers in Southeast Asia that are embracing Chinese m-payments. As Chinese tourists have become more adventurous, they expect retailers in more countries to offer m-payments.

In 2018, 60% of Chinese visitors to France, Italy, Germany or the UK had used m-payments, while 61% of those visiting North America had used their phone to pay. In Japan and South Korea, the figure was 70%.

According to the Nielsen survey, 94% of Chinese tourists said they would be more willing to pay with their mobile phones if this payment method becomes more widely adopted by local merchants in overseas markets. Indeed, 17% of Chinese tourists who traveled to the US or Europe in 2018 claimed the destinations they visited had few stores accepting Chinese m-payments.

Revealingly, 93% of Chinese tourists would likely increase their spending if mobile payment were more widely accepted. So, not only is accepting Chinese m-payments a key factor in making stores more convenient to Chinese tourists, but it boosts sales.

Openbravo Commerce Cloud offers a ready-made integration with the two leading Chinese m-payment systems, Alipay and Wechat, so making it easy for retailers to accept Chinese m-payments at the point of sale:

- The retailer simply selects the appropriate payment method on the POS and a QR code is displayed on the screen.

- The customer then scans the QR code with their phone and the payment is processed.

- A message confirming payment has been authorized appears on the POS and the transaction is completed.

Alipay and WeChat integration has been available since the 18Q1 release of Openbravo Commerce Cloud.

To find out more about mobile payments. watch our on-demand webinar, “Choosing the Right Mobile Payments Strategy for your Retail Business.“

No Comment