Retail Media Networks: a $100 billion opportunity for retail

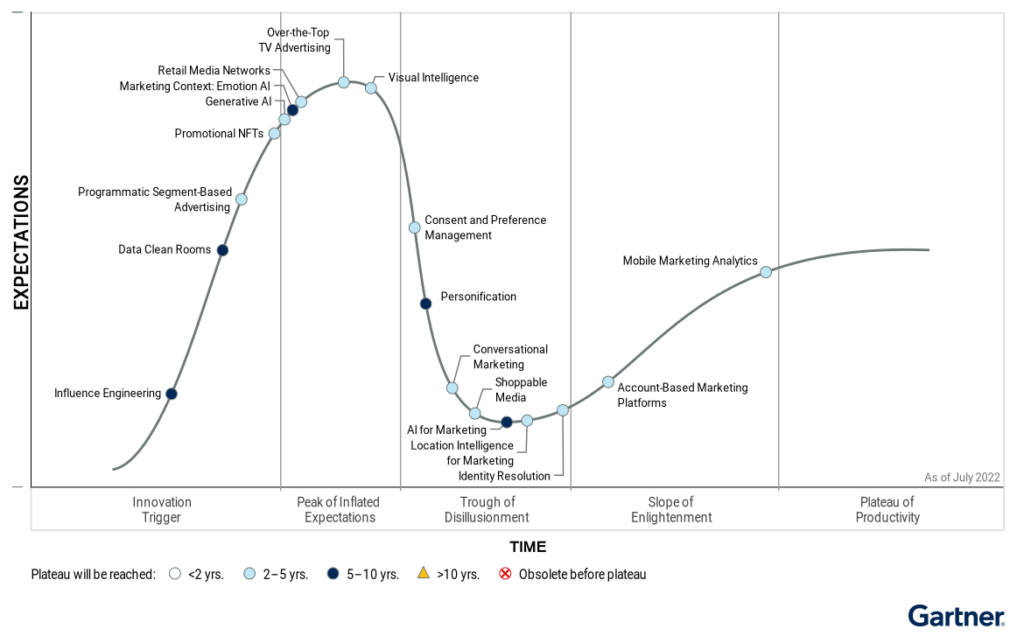

Retail Media Networks (RMNs) are one of the technologies included in Gartner’s latest Hype Cycle for Digital Advertising. It is a technology that is increasingly being talked about and is considered the latest trend in retail, excluding the metaverse and NFTs. It’s not surprising, considering that one of the objectives of retailers today is to search for new streams of income and profitability.

But what are Retail Media Networks (RMNs)?

A RMN is a network of digital channels owned by a retailer. It is made available to other brands that can purchase advertising space for campaigns using the retailer’s own data. It includes online display advertising, paid search across all available channels, as well as off-site display, video, and social media advertising, among other possible options.

According to eMarketer, 2022 was the year of retail media networks, with $40 billion spent on advertising in the United States. This figure is expected to reach $52 billion in 2023 and $61 billion in 2024. Similarly, McKinsey estimates that advertising spending will reach $100 billion in 2026. According to the consulting firm, this technology also transforms the value chain of the advertising industry, putting over $1.3 trillion of enterprise value at stake in the United States by 2026. It’s a significant figure.

Why are retail media networks a trend today?

According to a report by IAB Europe, the use of retail media networks by advertisers has skyrocketed in recent years due to several significant changes.

1. Changes in data privacy

Recent changes in data privacy have made retail media networks a more attractive channel for brands. Other channels, such as social media, have become less effective due to measures like Apple’s App Tracking Transparency (ATT), which do not affect retail media networks as severely. Therefore, retail media networks possess a hidden treasure trove of customer data, historically unavailable or only shared with brands to a limited extent, which can now be made available to advertisers.

2. Increase in online traffic and return to physical stores

The exponential growth of online traffic during the pandemic allowed retailers to reach an audience comparable to many digital media outlets. Today, the return to physical stores offers an excellent opportunity to provide advertising space to brands at locations close to the point of purchase, which advertisers find highly appealing. For stores, these potential revenues can offset some of the costs associated with maintaining a physical presence.

3. Need to find new streams of income and profitability

With retailers’ current need to seek new sources of income and profitability, retail media networks offer operating margins ranging from 50% to 70%. This presents a significant opportunity for retailers, especially those with historically single-digit margins. Amazon is a clear example that many retailers look up to. The American giant grew its advertising business to over $31 billion in revenue in 2021. Today, Amazon Advertising is the third-largest advertising network, following Google and Facebook.

Are they an option for any retailer and advertiser?

The answer is no. Retailers require significant investment in areas such as talent, technology, and agreements to create new businesses that function as digital advertising platforms. Retail media networks not only compete among themselves but also with all other available digital media options for advertisers. Competition is crucial because there is much at stake.

For brands, although there is potential interest for many of them, retail media networks are more popular today among consumer packaged goods (CPG) companies and other businesses that distribute through retailers.

The key to future success and greater opportunities for brands and retail media networks lies in their ability to demonstrate their capacity to drive both brand sales and value growth. This objective requires close collaboration between both parties but, considering the potential benefits, it is an effort that seems more than justified.

Most popular retail media networks in the United States and Europe

The United States clearly leads in the development of retail media networks by retailers and their use by advertisers. Amazon Advertising is the most widely used network, followed by Walmart Connect, Target Roundel, Kroger Precision Network, Instacart, Dollar General, Walgreens, Albertsons, Costco, and Sam’s, completing the list of the top 10 networks used by advertisers in 2022, according to the IAB Europe study.

The potential value for brands in using these networks can be seen in the case of Target’s Roundel, with over 100 million members in its loyalty program.

In Europe, tier 1 supermarket chains like Carrefour with their Carrefour Links network and Tesco with their Tesco’s Media & Insight Platform lead the market. Tesco, with significantly fewer members than Roundel, makes available the data of 20 million Clubcard holders for their advertising campaigns.

Note: The original text of this article was originally published in Spanish in the March-April 2023 edition of Dir&Ge magazine.