Physical stores still dominate researching and buying of most product categories

Despite the sensationalist articles warning about the Death of the High Street, it is clear that for some product categories, a physical store will likely remain the preferred way of shopping for some time. But which categories?

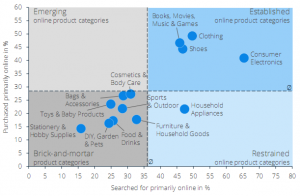

The latest Global Consumer Survey from research firm Statista attempts to classify those product categories that are most likely to be searched for and/or purchased online, and those for which the brick-and-mortar store remains the dominant channel.

It splits product categories into four different types:

- Established product categories are predominantly bought and searched for online. Fashion as well as consumer electronics and media products are in this group;

- Restrained product categories are researched for online, but are less likely to be purchased over the internet – something stops the consumer from clicking the “Buy Now” button. Household appliances belong to this category;

- Brick-and-mortar product categories, as the name makes clear, are those for which the internet does not yet dominate the research or buying process – at least, not yet. The majority of products fall into this category including do-it-yourself, food and drink, sporting goods, furniture and household goods;

- For completeness, there is a fourth quadrant, called Emerging, in the Statista diagram that represents goods are that bought online but not usually researched online. No products yet fall in this category.

Statista’s research gives a snapshot of just how far eCommerce has penetrated certain product categories but it is not predictive. Even if a product in the Established category, meaning many consumers are comfortable researching and buying it online, that does not mean that the future is inevitably going to be bleak for every brick-and-mortar retailer in that sector.

Take clothing, for example, which is in the Established category. Irish retailer Primark, which specializes in value fashion, this week, reported that like-for-like sales in its UK stores, its largest market, had grown 1.5 percent in its latest financial year. Spain, Portugal and its first four stores in Italy also delivered “very strong sales growth” in the year.

Its retail selling space increased by 0.9 million sq ft in the last financial year with 15 net new store openings. In its next financial year, it plans to open another 14 stores.

Primark has 350 stores in 11 countries and, notably, does not sell online. So for Primark, the advantages of brick-and-mortar retailing are sufficiently that it does not feel the need to also embrace e-Commerce. At least not yet…

To find out more about how Openbravo can give brick-and-mortar fashion retailers a competitive advantage, watch our on-demand webinar, “Omnichannel leader or laggard? What’s your choice as a fashion retailer?”

No Comment