Amazon Ups the Pressure on Brick-And-Mortar Retailers With Free One-Day Delivery

Amazon has announced plans to cut delivery times for its more than 100m Prime members in the US from two days to just one. The move puts further pressure on embattled brick-and-mortar retailers, who will have to try to match Amazon on speed or find other ways to encourage customers to choose their store — online or physical — instead of using Amazon.

Amazon has deep pockets and it plans to spend $800m on adding more trucks, warehouses and employees to help it meet the one-day delivery deadline. Its logistics infrastructure is not just extensive, but it is built for speed. According to a report by McKinsey:

“The company’s distribution network isn’t just big, it is also remarkably high-performing. Amazon’s network operates with a third fewer days of inventory than most major conventional retailers.”

Amazon has another advantage: it can offer fast shipping on 100m items, much more than competitors like Walmart and Target, which have tried to compete with Amazon on delivery times.

In Prime position

And it has a third advantage that few other retailers have managed to replicate, namely the Amazon Prime membership scheme, which creates the customer loyalty that eludes so many other retailers. Prime members spend an average of $1,400 a year with Amazon, more than twice the $600 spent by non-members.

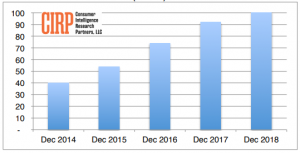

In return for $119 a year or $13 each month, Prime members get exclusive content and two-day – soon to be one-day in the US — delivery at no extra cost. Research firm Consumer Intelligence Research Partners (CIRP) says:

“Uniquely, through Prime, Amazon created a dedicated installed base of loyal retail customers. Stronger than a subscription business model, Amazon uses the power of member affiliation and a desire to amortize their fixed cost of membership across more member benefits, mostly by buying more stuff from Amazon.”

While growth is slowing, Amazon Prime membership has doubled in three years and almost quadrupled in five years.

One-day free shipping for Prime members will initially be rolled out in the US and then offered in all of its international markets, including Brazil, China and India.

Competing with giants

So how can you compete with eCommerce giants like Amazon on delivery times? It may not be economically viable for many retailers to try to do so. Indeed, it may not be necessary. Longer delivery times may be acceptable in some verticals – furniture, for example.

Maybe your customers give greater importance to delivery precision than speed, meaning they want to be able to choose a date and a time window for home delivery that is convenient for them. Or maybe they are like to come to you stores to pick up an item that they have ordered on your website, in which case Bopis might be a more effective weapon to compete with online-only etailers like Amazon.

According to RSR Research, 65% of shoppers who tried Bopis say it improved their shopping experience.

As Amazon continues to raise the bar, you need to understand better what expectations your customers have in areas such as delivery. That allows you to create the supply chain most appropriate to your needs, boosting efficiency and demand responsiveness and ensuring the optimal placement of inventory in the supply chain.

No Comment